does nj offer 529 tax deduction

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. New Jersey does not offer a deduction for 529 plan contributions.

What Is An Utma Ugma 529 Plan And Do You Want One

Either the child or the account owner must be a NJ resident.

. A key benefit of both NJ 529 plans is the NJBEST Scholarship. Does NJ offer 529 tax deduction. For more information please see NY 529 Plans.

New Jersey has two 529 savings programs both. Best 529 Plans in New Jersey. 5000 single 10000 joint.

New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. Thats a deduction of up.

There is no time in which the funds within a New Jersey 529 plan need to be withdrawn. 2 NJBEST Scholarship - 500-1500 towards first semester of higher education at an accredited New Jersey school we explain details here. The NJ 529 tax deduction is part of a comprehensive college affordability plan in the states fiscal year 2022 budget.

Therefore the best states from a tax perspective will be those that offer the biggest deductions. Some state 529 plans allow contributions to the plan to be deductible for in-state residents. New Jersey offers two 529 college savings plans said.

To get started you can deposit 25. But if you live in New York and pay New York state income taxes you may be able to deduct the contributions on your New York tax return. No New Jersey does not offer tax deductions for 529 plans.

Fee is the percent of the fund deducted annually for fees based on a moderate risk. Thankfully NJ residents can open an account in any other state that lets them. Youll enjoy a deduction of up to 10000 per year 20000 if married and filing jointly and you pay no state income tax on earnings and withdrawals that are used for qualified college expenses 1.

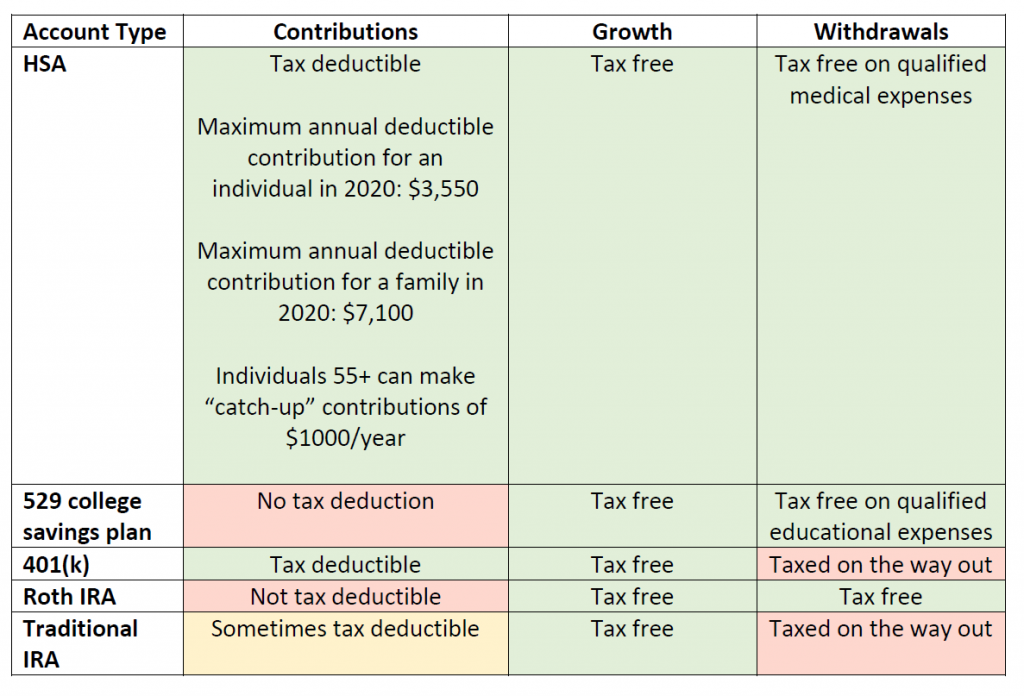

Direct this New Jersey 529 plan can be purchased directly from the state. 5000 per parent 10000 joint. Contributions to a 529 are after-tax and not federally tax deductible.

Note that there is no federal income tax deduction on 529 plan contributions. You must be a New Jersey resident to contribute to a. The New Jersey College Affordability Act allows taxpayers with household adjusted gross.

Age 0-6 High Equity. What happens to a New Jersey 529 Plan if not used. If you use the money for qualified.

Rowe Price College Savings Plan. Most states that have an income tax allow either a deduction from income or a state tax credit for 529 plan contributions when reporting income for state tax purposes. New Jersey does not offer any state tax benefits for opening a NJ 529 plan.

New for Tax Year 2022 The New Jersey College Affordability Act created three new income tax deductions for taxpayers with gross income under 200000. College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. Contributions of up to 15000 per beneficiary can be funded annually and married couples can contribute up to 30000 annually.

You can also deduct the contribution. Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits. New Jersey does not provide any tax benefits for 529 contributions.

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Some states do have income taxes but no 529 plan tax deduction. Section 529 - Qualified Tuition Plans.

According to the guidelines my qualified expenses are reduced by 4000 to. You must have a gross income of 200000 per year or less. New Jerseys plans do not give that advantage.

It rewards you for simply opening a NJ 529 plan and saving. New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022. The New Jersey College Affordability Act allows for New Jersey taxpayers with gross income of 200000 or less to qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022.

In New Mexico families can deduct 100 of their contributions to New Mexicos 529 plan on their state taxes. A 529 plan is designed to help save for college. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

While most states have dollar limits on 529 deductions Colorado New Mexico South Carolina and West Virginia allow you to deduct the full amount of contributions to their respective 529 plans. For my federal return I claim the full 2500 American Opportunity Tax Credit AOTC based on 4000 of the Qualified Education Expenses. New Jersey is the 35th state to offer an income tax benefit for residents who contribute to a 529 plan.

However not all states follow the federal tax treatment of K-12 tuition or student loan expenses. 1 Favorable treatment when you apply for financial aid from the state of New Jersey. Residents will be happy to hear that the answer is now YES.

The NJBEST Scholarship is not need-based means-tested or merit-based. Starting in 2022 New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. More information is available on the creditdeduction.

But it does offer these two key benefits. Say I have qualified education expenses of 10000 and I take a withdrawal of 10000 from a 529 Plan and 1000 are earnings. Contributions to such plans are not deductible but the money grows tax-free while it remains in the plan.

How much of 529 is tax deductible. New Jersey taxpayers with household adjusted gross income between 0 and 75000 may be eligible for a one-time grant of up to. Unlike many states the IRS does not provide a current tax deduction for contributions made to the plan.

To be clear here at AboveBoard we dont love either NJ 529 plan.

529 Olive Ter Union Twp Nj 07083 Realtor Com

Using A 529 Plan When College Is Remote Putnam Investments

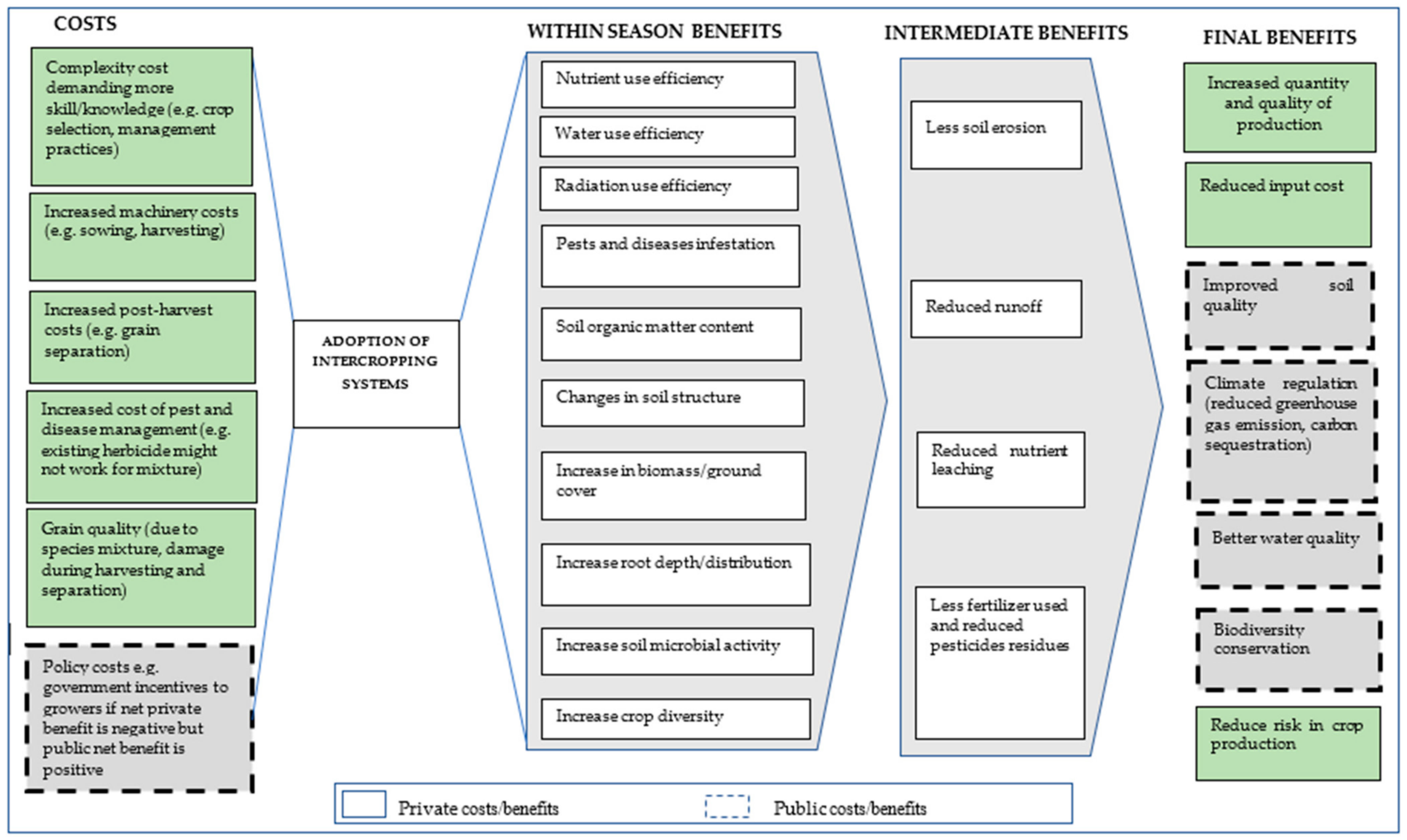

Agriculture Free Full Text Intercropping Evaluating The Advantages To Broadacre Systems Html

State Tax Incentives For Employer 529 Plan Matching

The State Of The Inheritance Tax In New Jersey The Cpa Journal

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Home New Jersey Student Financial Aid Hesaa

Home New Jersey Student Financial Aid Hesaa

The State Of The Inheritance Tax In New Jersey The Cpa Journal

When Renting Property To Relatives Know The Tax Rules Cbs News

Home New Jersey Student Financial Aid Hesaa

Home New Jersey Student Financial Aid Hesaa

Can I Avoid The 529 Plan Withdrawal Penalty Bankrate

Online Colleges In New Jersey 25 Best Online Schools In Nj

30 Ways To Make Tax Season Less Scary Gobankingrates

Health Savings Accounts Can Be More Valuable Than 401 K S And Iras

/142295198-56a776485f9b58b7d0eab2c3.jpg)

What Is An Utma Ugma 529 Plan And Do You Want One