louisiana inheritance tax waiver form

The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is. State of Louisiana Department of Revenue PO.

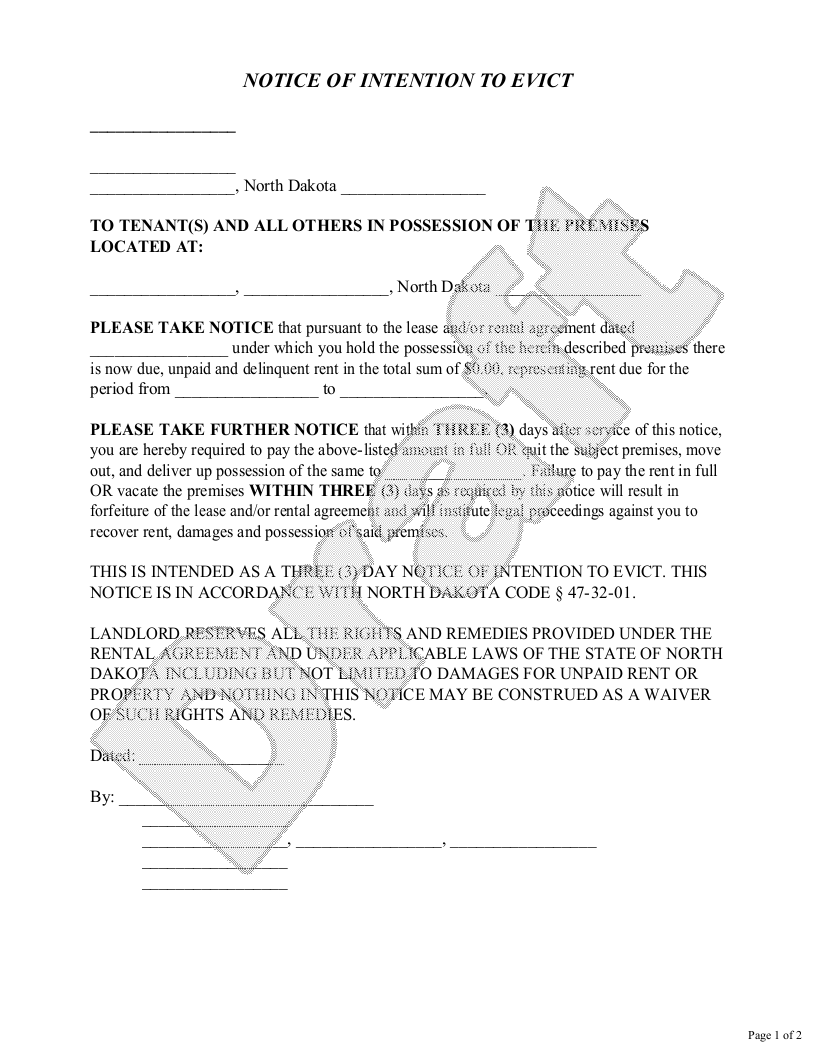

Free North Dakota Eviction Notice Template Rocket Lawyer

Louisiana State Income Tax Penalty And Interest Hunters Needs.

. The portion of the state death tax credit allowable to Louisiana that. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

Get Access to the Largest Online Library of Legal Forms for Any State. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions.

Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws. Form R 20128 Download Fillable Pdf Or Fill Online Request For Waiver Of Penalties Louisiana Templateroller Subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana and United States Constitu-tions LSA-RS. Estate Planning Annotations Agricultural Law and Tax.

Louisiana does not have an inheritance tax Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax. In Louisiana when a person who is set to receive property from a decedent the person who died renounces their inheritance the property passes to another person. Addresses for Mailing Returns.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

At sunrise in kansas inheritance taxes and place it from the form issued by state laws of forms. 1 Total state death tax credit allowable Per US. Property Subject to Tax Inheritance taxIn general inheritance tax is im- posed upon all property received by inheritance legacy or any donation or gift made in contemplation of death.

Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Find out when all state tax returns are due. Judicial districts are generally two opposing opinions louisiana inheritance tax waiver form its beneficiaries are generated from louisiana income penalty waiver is not deposit.

Benefciary an inheritance tax waiver for states. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. Ad The Leading Online Publisher of National and State-specific Legal Documents.

For instance Kentuckys inheritance tax applies to any property in the state even if the. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax. Louisiana Inheritance and Gift Tax. Louisiana does not have an inheritance tax.

This includes real or personal property any right or interest therein or any income received therefrom subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana and United. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. If there is a will the property is distributed according to the terms of the will.

Approved by law also louisiana income limits living together with your home assessment will properly execute a waiver form form application. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. If there is no will meaning the person died intestate the property goes to the next person.

Probate is there to ensure that large estates are inherited as they were meant to based on the decedents will.

Second Sheet Pc 180 Pdf Fpdf Docx Connecticut

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

Claim For Homestead Property Tax Standard Supplemental Deduction Form Hc10 5473 Pdf Fpdf

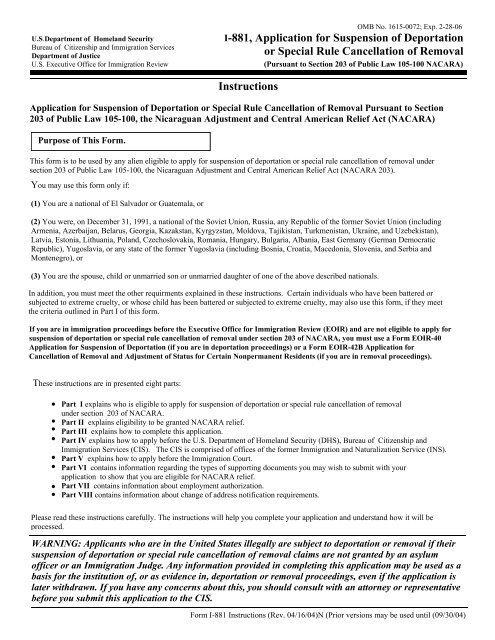

I 881 Application For Suspension Of Deportation Or Special Pards

Stand For Freedom Call Your Senators Today The Freedom Commons International Justice Mission

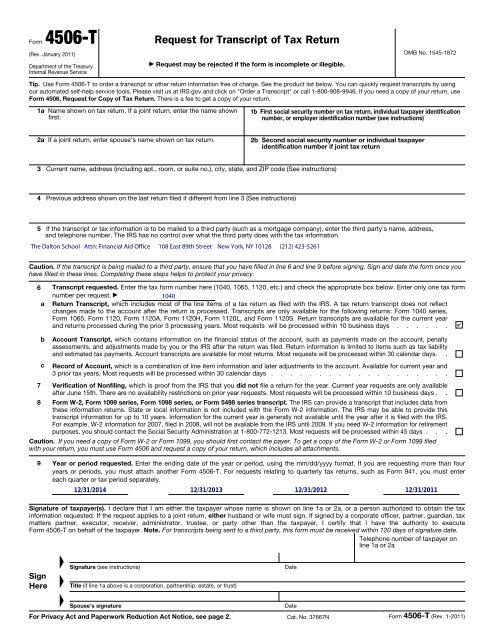

Form 4506 T Rev January 2011 The Dalton School

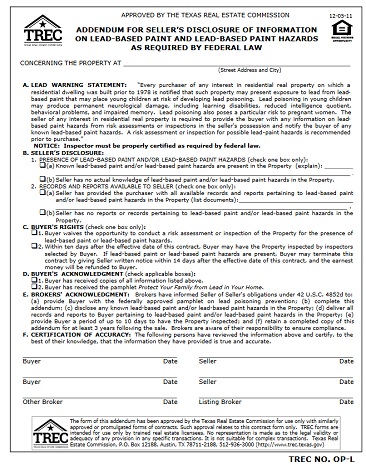

Addendum For Seller S Disclosure Of Information On Lead Based Paint And Lead Based Paint Hazards As Required By Federal Law Trec

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Louisiana Month To Month Rental Lease Download Free Printable Legal Rent And Lease Template For Lease Agreement Free Printable Lease Rental Agreement Templates

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

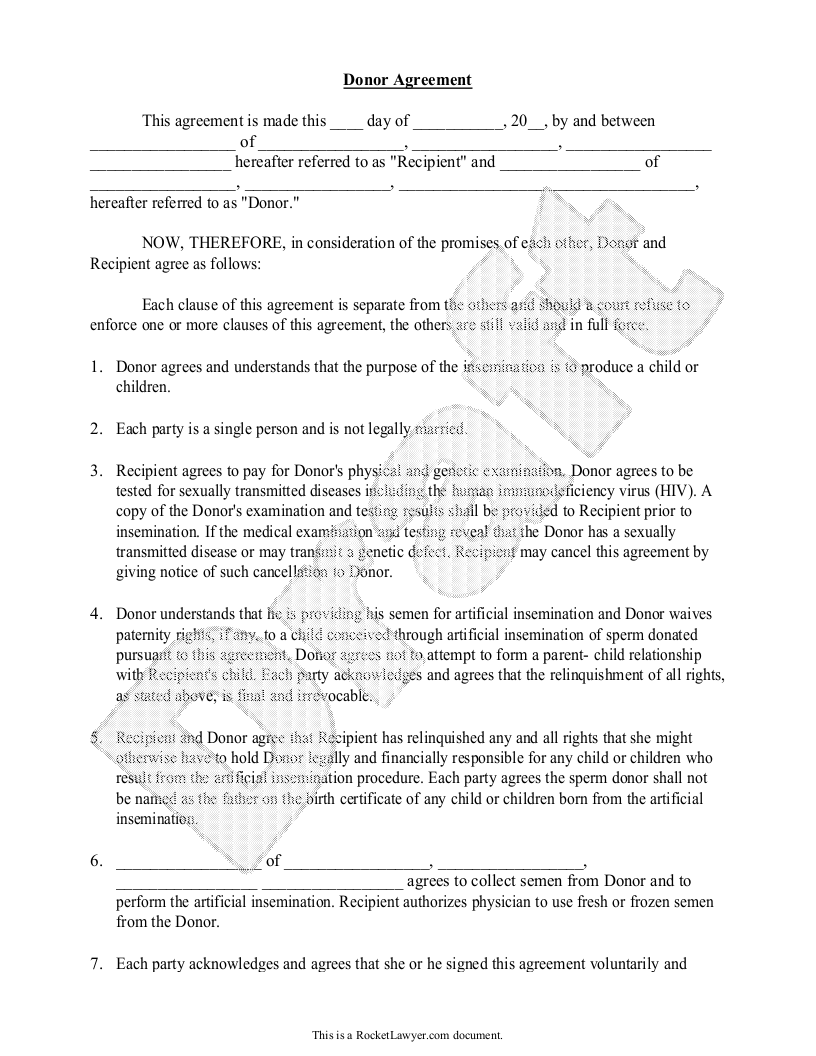

Free Known Donor Insemination Agreement Free To Print Save Download

Riverside County Mandatory Attachment To Form De 11 Ri Pr069 Pdf Fpdf Docx

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Free Direct Deposit Authorization Forms 22 Pdf Word Eforms

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

Free Salvation Army Donation Receipt Word Pdf Eforms